1. Quicken Premier

Quicken Premier remains one of the most popular financial planning software programs in 2025. It offers a comprehensive suite of tools for budgeting, investing, and managing personal finances.

Key Features:

- Budgeting Tools: Create detailed budgets and track spending across multiple categories.

- Investment Tracking: Monitor your investment portfolio with real-time market updates.

- Bill Management: Track due dates and pay bills directly from the software.

Quicken Premier is ideal for individuals looking for an all-in-one financial management solution.

2. Personal Capital

Personal Capital is a top choice for those focused on investment management and retirement planning. It combines powerful financial tools with personalized advice from financial advisors.

Key Features:

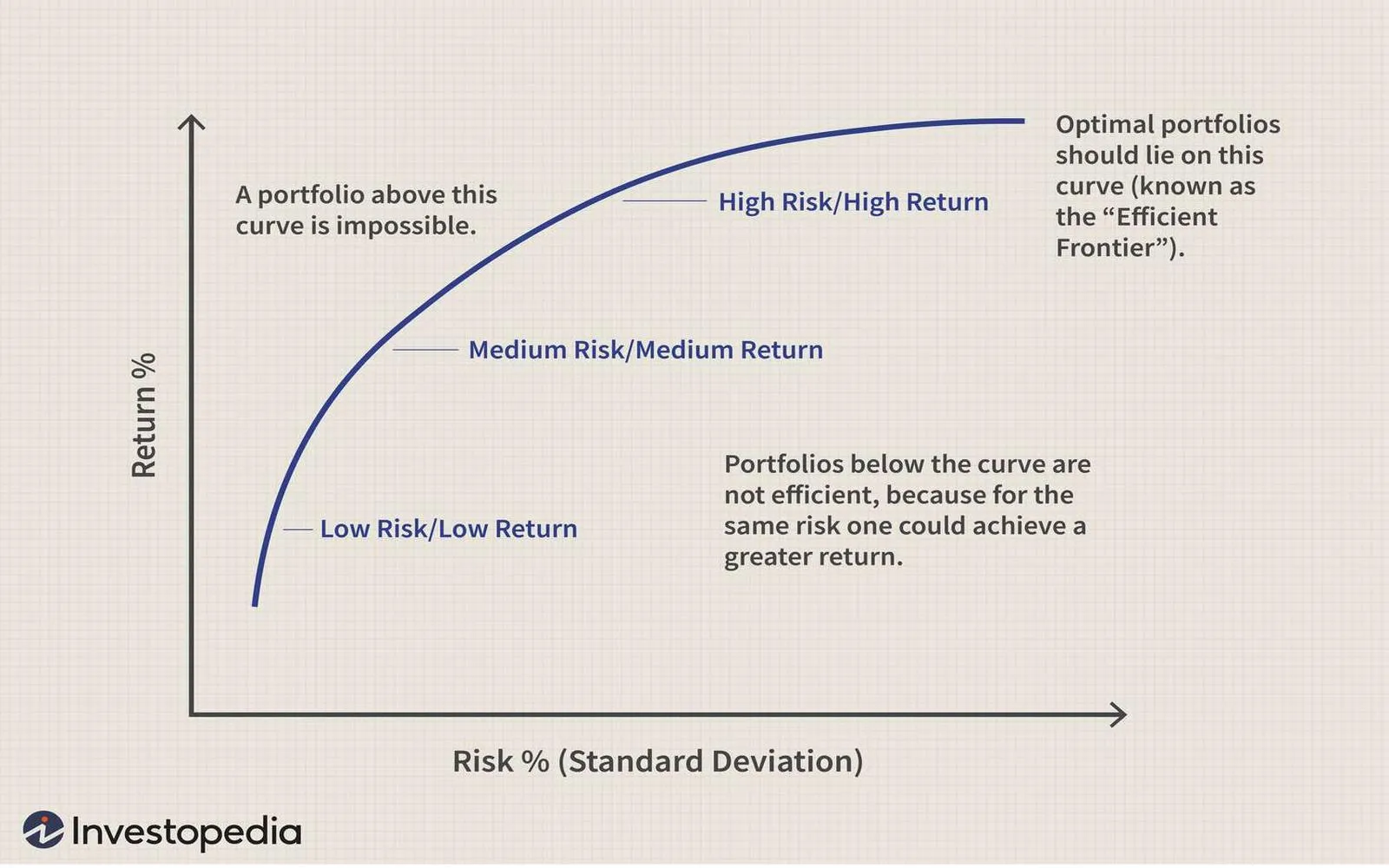

- Investment Checkup: Analyze your portfolio and receive tailored investment advice.

- Retirement Planner: Plan for retirement with detailed projections and scenario analysis.

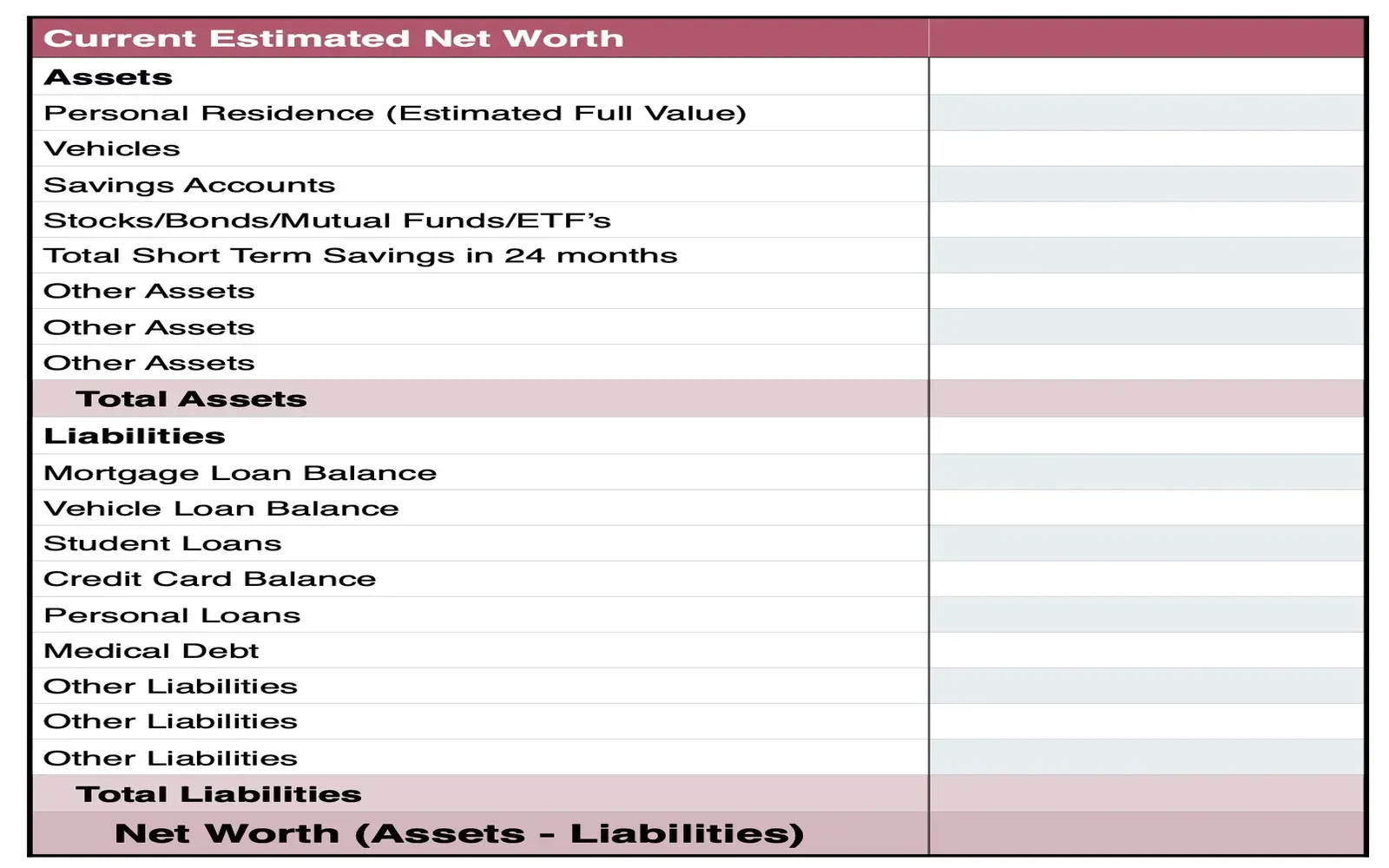

- Net Worth Tracker: Get a complete picture of your financial health by tracking assets and liabilities.

Personal Capital is perfect for users who want to optimize their investments and prepare for a secure retirement.

3. YNAB (You Need A Budget)

YNAB is designed for users who want to take control of their budgeting process. Its unique approach focuses on giving every dollar a job and helping users break the paycheck-to-paycheck cycle.

Key Features:

- Real-Time Tracking: Sync your accounts and track spending in real-time.

- Goal Setting: Set and achieve financial goals with customizable plans.

- Debt Payoff: Create a plan to pay off debt faster and save on interest.

YNAB is ideal for individuals who want to master their budgeting skills and achieve financial freedom.

4. Mint

Mint is a free, user-friendly financial planning app that offers a wide range of features to help users manage their finances.

Key Features:

- Budgeting: Create and monitor budgets with easy-to-use tools.

- Bill Alerts: Receive reminders for upcoming bills and due dates.

- Credit Score Monitoring: Track your credit score and receive tips to improve it.

Mint is perfect for users looking for a cost-effective way to manage their finances with minimal effort.

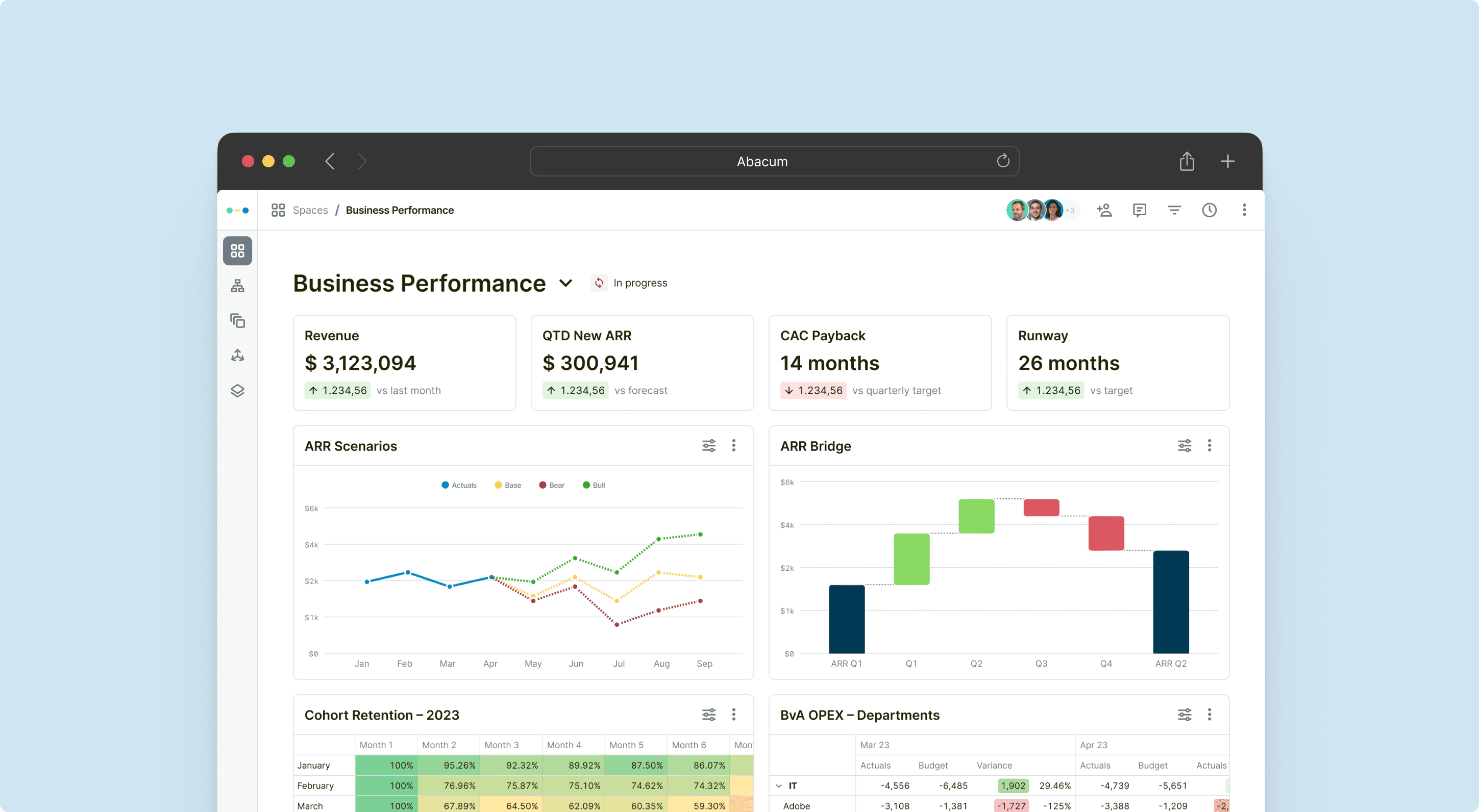

5. eMoney Advisor

eMoney Advisor is a professional-grade financial planning software designed for financial advisors. It provides a comprehensive suite of tools to help advisors create detailed financial plans for their clients.

Key Features:

- Client Portals: Provide clients with secure access to their financial information.

- Advanced Planning Tools: Create detailed cash flow projections, estate plans, and more.

- Collaboration Features: Work collaboratively with clients to develop and adjust financial plans.

eMoney Advisor is ideal for financial advisors who want to offer top-notch financial planning services to their clients.

Comparison Chart of Top Financial Planning Software Programs

To help you choose the best financial planning software for your needs, here’s a comparison chart of the top options for 2025:

| Feature | Quicken Premier | Personal Capital | YNAB | Mint | eMoney Advisor |

|---|---|---|---|---|---|

| Budgeting Tools | Yes | Yes | Yes | Yes | Yes |

| Investment Tracking | Yes | Yes | No | No | Yes |

| Bill Management | Yes | No | No | Yes | No |

| Retirement Planning | Yes | Yes | No | No | Yes |

| Credit Score Monitoring | No | Yes | No | Yes | No |

| Professional Use | No | No | No | No | Yes |

| Cost | Paid | Free/Paid | Paid | Free | Paid |

Conclusion

Choosing the right financial planning software is essential for effective financial management. Whether you’re an individual looking to improve your budgeting skills or a financial advisor seeking professional-grade tools, there’s a financial planning software program that meets your needs. Consider the features and benefits of each option to make an informed decision and take control of your financial future in 2025.

By utilizing these top financial planning software programs, you can achieve your financial goals, manage your investments, and plan for a secure retirement.